2024 Domain Sales and Acquisitions and 2025 Predictions with Tess Diaz, it.com Domains

- by Ilona K.

Table of contents

Every year, we review the most significant domain sales and acquisition trends to keep you up to date with the industry. Discover the most prominent trends and what to expect in 2025 with Tess Diaz, Director of Channel Development at it.com Domains.

Around this time last year, we made a series of predictions for the domain name aftermarket sales. This year we’re here to review the 2024 whirlwind, particularly with the exponential adoption of the TLD related to IT (.io, .online, .site, .app) and artificial intelligence (.ai).

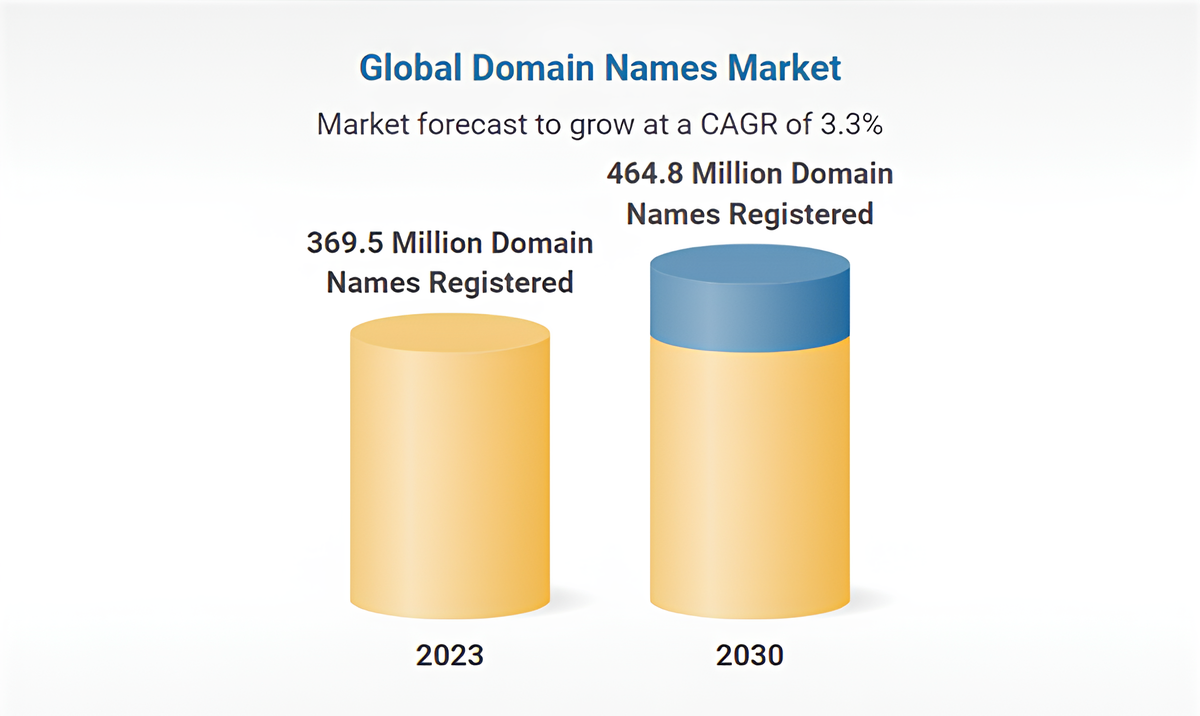

The global market for domain names is projected to reach 464.8 million domain names registered by 2030, growing at a yearly growth rate of 3.3% from 2023 to 2030. Notably, the analysts have lowered their predictions: last year, the growth rate till 2030 was predicted at 7%. Across all TLDs (top-level domains), there were 362.3 million domain names registered at the end of Q3 2024, which represents a 1% growth year over year.

However, in addition to the new domain registrations, aftermarket sales provide valuable insights on market trends, growth rates and expected developments. Influenced by technological advancements, evolving consumer behaviors, and strategic business initiatives, here’s how 2024 looked like in public sales and acquisitions.

Please note that private sales, which are significant in both number of transactions and totalling 8-9 figures USD, are not incorporated into this data. Here at it.com Domains, we spend a lot of facetime at industry events around the globe, engaging in conversations to develop our relationships and to truly understand the nuances of the market. Nothing quite replaces conversations (and negotiations!) eye-to-eye.

2024 in Domain Name Sales & Acquisitions

The publicly reported aftermarket witnessed nearly 623k domain name sales - approximately 18% less than in 2023. The number of ‘whale’ deals for over $1 million stayed stable - six deals for over a million in 2024 vs five in 2023. The ‘average order value’ or the average size of the top-100 deals was up 11%.

Although the market analysts have noted a drop in popularity of .com domain zone for some time now, the most expensive sales of 2024 (and all deals exceeding $1M, just like in 2023) were still registered in the .com TLD.

Topping the public list, Rocket Companies, the parent of Rocket Mortgage, paid $14 million to acquire the Rocket.com domain name. Gold.com (bought by JM Bullion, an online precious metals trading company, for $8.5 million) and shift.com ($1.37 million) close the top-3 domain name deals of 2024. The only domain name outside of the .com zone in the top-10 was bet.bet, sold for $600k.

| Rank | Domain | Price | Date | Venue |

| #1 | rocket.com | $14,000,000 | 2024-09-04 | Hilco Digital Assets |

| #2 | gold.com | $8,515,000 | 2024-03-11 | Hilco Digital Assets |

| #3 | shift.com | $1,365,000 | 2024-03-25 | Hilco Streambank |

| #4 | tp.com | $1,200,000 | 2024-02-10 | Afternic |

| #5 | bestodds.com | $1,025,000 | 2024-12-31 | Private |

| #6 | koko.com | $1,000,000 | 2024-08-01 | Atom.com |

| #7 | fair.com | $900,000 | 2024-03-25 | Hilco Streambank |

| #8 | bet.bet | $600,000 | 2024-02-20 | TOP.DOMAINS |

| #9 | rural.com | $550,000 | 2024-05-29 | GetYourDomain |

| #10 | continue.com | $550,000 | 2024-08-31 | LegalBrandMarketing |

Our prediction last year about the surge of interest in AI-related domain names was a highlight of the year. The number of domain names from the .ai zone in the top-100 sales grew from nine in 2023 to a whopping 20 in 2024. Moreover, 13 out of those 20 domain names were sold for more than $100k each (up from five in 2023). The integration of AI technologies influenced domain strategies, with businesses seeking .ai domains to align with industry trends.

Notably, .ai domain zone is an example of a ccTLD (country-code top level domain), which used to belong to the government of Anguilla. The trend for using ccTLD as generic domain zones, as predicted, continued its growth in 2024. Five domains in the .io zone, nominally assigned to the British Indian Ocean Territory, were sold for over $100k (vs three in 2023). The financial benefits from domain registrations have significantly impacted smaller economies like Anguilla's, where domain registration fees have become a major revenue source, supporting infrastructure projects and public services.

While in general domain names in ccTLDs tend to have a lower price tag if compared to the same names in generic zones like .com, a few country-specific sales made it into top-100. For example, mortgagebroker.com.au was acquired for nearly $200k, crypto.co.uk - for $129k and 0.co - for $125k.

Finally, our prediction for an increase in interest (and consequently, the prices) for the new top-level domains (nTLDs) has also proven accurate. Just like in 2023, one domain name (bet.bet, which sold for $600k) made it to the top-10 in the domain sales chart of 2024, and it’s again a deal in the betting industry. It has been one of the fastest growing online sectors over the past two decades and category-related domain names are on the rise. Another example from the same nTLD - casino.bet - was sold for a hefty $200k.

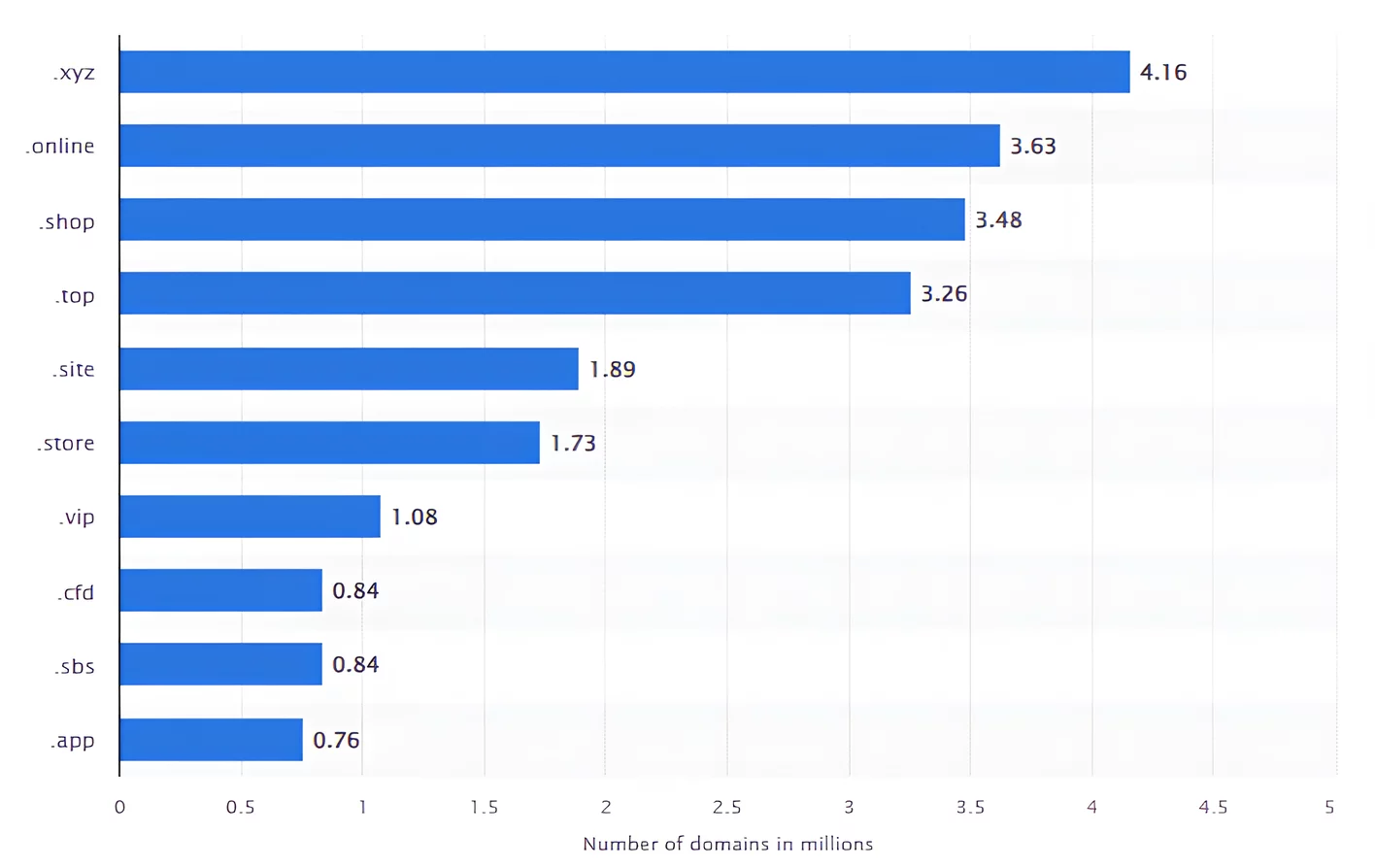

Other nTLDs such as .love, .game and .app have also registered top dollar sales in the past year. Notably, 5/100 top domain name sales happened in the .xyz zone, indicating that businesses are looking for alternative (and, possibly, price sensitive) options to the more established and hence populated domain zones.

2025 Domain Sales: Looking Ahead

The domain name industry in 2024 demonstrated resilience and adaptability, with sustained growth in traditional TLDs and a marked increase in the adoption of new and niche extensions. The influence of emerging technologies and evolving business strategies continues to shape the domain landscape, indicating a dynamic future for the industry. Let’s explore the industry expectations a bit further.

1. Surging investment in AI-related domains

The interest of both businesses and domain investors in AI-related domain names is not expected to slow down in 2025. With ‘AI’ being the most searched keyword on Sedo in 8 out of 12 months of 2024, the number of domain registrations in the .ai zone has surged from only 60k in 2022 to 551k in January 2025.

However, the increase in registrations and overall interest will inevitably drive the price of .ai domain names up. Hence, we expect the market to evolve in two ways: growing price tags of .ai domain names in the aftermarket, as well as a potential exploration for more affordable AI-related domain name solutions by businesses of any size.

Artificial intelligence is also expected to have a wider impact on the domain name industry - from AI-powered domain name search to valuation, optimization for search and security.

Aftermarket values of premium .com domains continue to skyrocket due to limited supply and high demand. In this landscape, smaller and medium-sized companies are increasingly choosing domain names that align with their specific niche, vertical, or industry, particularly when that industry is tech. This is driving the continuing increases in aftermarket and new registration sales of .ai, .io, and .it.com domains.

2. IT, crypto and betting industries driving demand

As discussed above, the trend for using country-level domain zones as generic ones extends beyond .ai domains, with other ccTLDs like .tv (Tuvalu) and .co (Colombia) also experiencing increased registrations due to their relevance in the tech industry. Also, giving such examples from 2024 sales like solutions.com ($415k), quantum.xyz ($199k), and open.network ($100k), we anticipate IT startups to continue hunting for the memorable and relevant domain names, including the ones available on .it.com.

Another segment where the demand continues to grow is represented by Web3 and crypto businesses. Being at the forefront of the tech industry, those ventures explore both ccTLDs (crypto.co.uk sold for $129k) and new top-level domains (defi.app sold for $150k and stable.xyz - for $100k). The emergence of blockchain-based extensions, such as .crypto and .eth, offers decentralized alternatives to traditional systems - these domains are gaining traction, particularly among tech-savvy communities.

Finally, the betting industry continues to be open to investing big in the right domain names. Apart from bet.bet mentioned above, sales of domains like betz.com ($240k) and casino.bet ($200k) demonstrate the intention of businesses to capture potential users with short and generic domain names. High-value sales of numeric betting domains like 69bet.com ($140k) indicate a trend, possibly due to their memorability and cultural significance in certain markets.

Globally, companies and entrepreneurs continue to expand their online presence. It’s notable that a significant portion of the VC funds infused into the economy are geared towards the technology sector: a whopping 50.8% of global VC funding in Q4 2024. The Wall Street Journal reports and expects 45% of 2025’s funding to continue this trend. Historically, such attention directly drives growth in almost every segment of the domain name market.

3. New TLDs growing in volumes and price tags

While traditional extensions like .com and .net have dominated the market, there's a notable decline in their registrations, with a combined drop of 1.1 million domains. In contrast, new top-level domains (nTLDs) have experienced a 17.4% increase year-over-year in 2024, offering businesses more specific and memorable options such as .tech, .shop, and .app.

Notably, .top zone covers about 1.84% of all domain registrations and is #8 in the top-10 TLDs by the share of registered domains, with .info being #10 with 1.36%. Zones such as .cloud, .online and .xyz are amongst the top growing new zones, and even some non-tech related zones have recorded high-value sales in 2024 (people.love sold for $255k, and green.earth for $85k).

As we predict the number of domain sales in nTLDs to grow in both volume and price, it would be also curious to monitor the demand shifts in anticipation of the next round of nTLDs scheduled to begin in April 2026.

This data leads to incredible excitement as the industry gears up for ICANN’s 2026 round of nTLDs. The entities pursuing nTLDs have become significantly more sophisticated since 2012, with more structured capital and highly focused marketing strategies, fostering strong optimism for success.

Keen to stay on top of the domain industry trends? Visit it.com Domains blog and follow us on social media.

Read also

Expert Opinion

- 5 min read